<object width="425" height="344">

<embed src="http://www.youtube.com/v/tpIWbYs8sec&rel=0&color1=0xb1b1b1&color2=0xcfcfcf& hl=en&fs=1" type="application/x-shockwave-flash" allowfullscreen="true" width="425" height="344"></object>

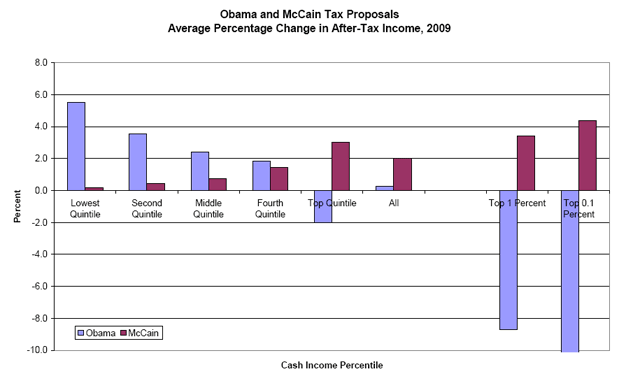

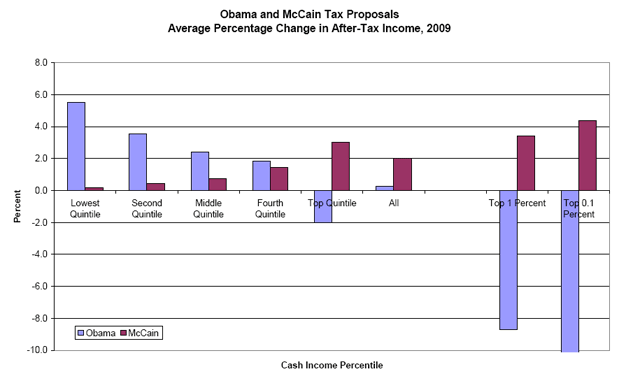

And this for ya, the net effect of either sides tax proposals:

<embed src="http://www.youtube.com/v/tpIWbYs8sec&rel=0&color1=0xb1b1b1&color2=0xcfcfcf& hl=en&fs=1" type="application/x-shockwave-flash" allowfullscreen="true" width="425" height="344"></object>

And this for ya, the net effect of either sides tax proposals:

Comment